Benefit from a direct & flexible relationship with your talent

You can expand hiring across Europe with the ability to administer your own unique benefits to your talent abroad and preserve your brand. Leverage global HR support, including global payroll management.

Hire across europe with flexible options

Growing a business abroad can be complex, especially if you

want flexibility with how you hire with your brand in new markets.

Leave this challenge with WorkDirect. We make it easy to adapt

your expansion strategy to your needs without having to compromise your brand presence.

Hire across Europe while preserving your brand name - offer custom benefits to your talent while we support global payroll and your local employer registration

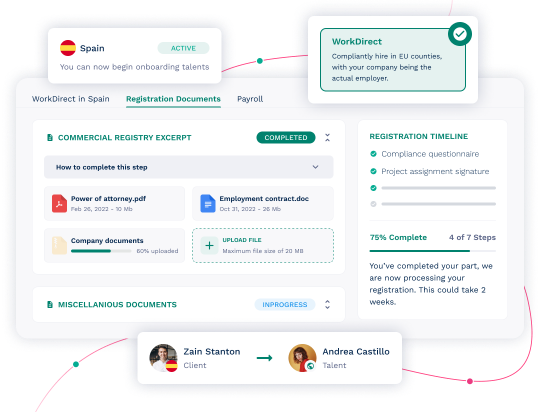

Register as an employer

We assist with your local company registration which enables you to hire in the target country under your brand. With a network of local experts, we provide full guidance including legal and compliance support as well as document filing. We have streamlined this process so you can be set up in a matter of weeks!

Contract administration

Accelerate talent onboarding with contract templates reviewed by experts with deep knowledge of local country regulations. Customised benefits can also be offered to talent while ensuring 100% legal compliance.

Comprehensive reference guides

Consult our database of knowledge sheets with in-depth guides on what you need to consider when hiring talent abroad.

Payroll administration, reporting & payslips

Onboard your talent for payroll services seamlessly. Through the platform, receive timely payroll reporting for each target country with detailed instructions on how to administer payment. Payslips are sent to employees in all countries.

Where WorkDirect services are available

How it works

Data Gathering in WorkMotion Platform

Data Required from Employer & Employee

- Commercial register

- Power of Attorney

- Passport copy of Director(s)

- Employee Contract

Registration & Payroll Setup

Average duration is approximately 3-6 weeks. Timeline is dependant on target country regulations and when all client documents are received.

Monthly Payroll Run

- Provision of monthly payslip to employee

- Monthly payroll report

- Country with tax and contributions payment instructions

- Client is responsible for direct

- Payment of salaries, taxes and contributions.