Onboard Your Indian Workforce With An EOR

Date

Reading Time

From mid-April, the second wave of the pandemic swept through India, resulting in a record breaking surge of 412.431 new cases on Wednesday (5th May) and a death toll of 3980.

In order to block the spread, countries all over the world have set up a travel ban to and/or from India to protect the world from a “double mutant” COVID-19 variation.

Since April 26th Germany has designated India as a country with significantly elevated risk of infection, banning the entry to passengers who have visited India in the past 10 days, even with a valid visa.

The global need for Indian IT talent

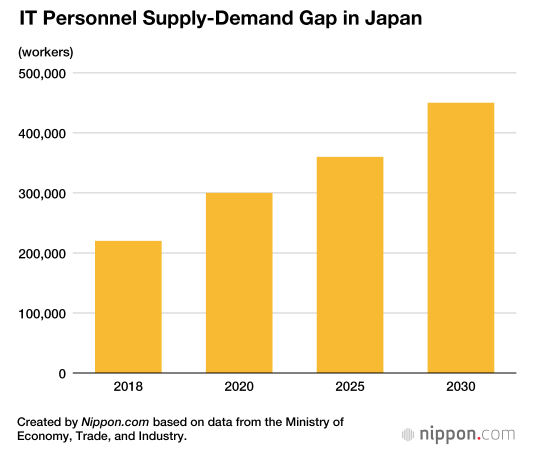

Digitalisation has become a priority for countries all over the world. However the shortage of IT engineers is creating important issues to reach digitalisation targets, as it is the case in Japan.

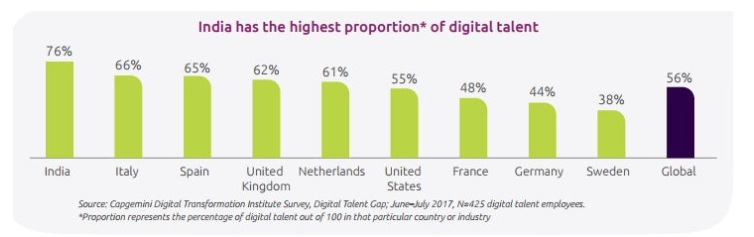

This has led recruiters to turn overseas when looking for IT workers, with India providing the best match of skills and ability.

This is also highlighted by a survey conducted by LinkedIn and Capegemini, indicating that India is the most important source of digital talent with 76% proportion of digital talent in the country, followed by Italy at 66%.

This comes as no surprise since according to the All India Council for Technical Education, a government body in India, the country counts with more than 100,000 universities of technology and other institutions training IT engineers.

Remote work as a solution

The travel ban has caused important collateral damage for many companies, one of them being companies not being able to relocate foreign employees and sharpening the shortage of talent.

As an Employer of Record (EOR), we are familiar with the pain points that companies face when trying to access talent from abroad. Often, specific positions are not easy to fill, especially with a limited talent pool.

But missing out on much needed IT engineers and digitalization experts because of geographical barriers would be a shame.

Especially now, in times of a booming remote work approach, we have learned that mobility is overrated when accessing talent.

So, even though you might not be able to bring your Indian employees into the European borders, this does not mean that they will not be able to work for your company as a whole.

Labour compliance in India

The Indian labour law is quite flexible, facilitating a compliant remote onboarding process of your employees.

Let’s have a closer look.

Payroll Taxes

Social security

India’s social security is composed of the Employees Provident Fund (mandatory if the company has over 20 employees), the Miscellaneous Provisions Act, Employees State Insurance and a pension scheme. It covers pension, health, injury and unemployment.

Healthcare

Healthcare is made of contributions by the employee, employer and government.

• Employee – 1.75% of wage

• Employer – 4.75% of payroll

• Government – 12.5% of medical bill costs

National Pension

Pension consists of a pension scheme and a provident fund.

Contributions are made by the employee, employer and government:

• Employee – (Provident Fund) 12% of basic wages

• Employer – 8.33% of monthly payroll. (Provident Fund) 3.67% of monthly payroll and .5% of monthly payroll for administrative cost. 8.33% of monthly payroll is contributed for employees 58 or older.

• Government – 1.16% of basic wages

Employee (Benchmark) Benefits

• Disability Insurance – Personal Accident Insurance coverage of 1.5 times the Annual Gross salary

• Life Insurance – 1.5 times the Annual Gross salary capped at Rs.4,000,000.

• Annual Health Check-up – All full-time employees can avail this benefit once in a Calendar year.

• Pension Contribution – 12% of monthly basic salary of provident fund and gratuity based on the

years of service with the company.

• Health care (Private Benefit) – Hospitalization insurance covering employees, their spouse and 2 dependent children.

• Allowance – Housing fund allowance.

• Internet Reimbursement: Monthly reimbursement policy

• Gratuity – In accordance with the Gratuity Grant, employees are entitled to fifteen days of salary for every completed year of service payable on termination, retirement, or resignation after completion of 5 years of continuous service.

Public Holiday

There are three national holidays where Businesses must be closed: Republic Day, Independence Day and Gandi Jayanti; and no substitute holiday system in India.

How we can help

Due to the current situation, many of our clients are looking for solutions and asking us for advice to hire employees that are currently located in India and were supposed to relocate to Germany.

If you are not familiar with the term Employer of Record, we recommend having a look at our blogpost.

In a nutshell, we are the registered employer for the worker while not holding a management role towards the employee.

We take care of

…being the country interface between the employee and government authorities

…advising the client of termination rules and severance pay

…making sure that all the local labor laws concerning local contractors and worker protection are met

…assuring a compliant payroll inside of the country

…arranging visas and work permits for the employee.

All together, WorkMotion helps you access your prospect talent and make sure you remain compliant.

If you need more information on onboarding your Indian workforce as easily and compliantly as possible, make sure to contact us.

Latest articles

Overcoming talent shortage in Germany with global hiring

10 awesome remote work rituals you should implement in 2024