So you’re thinking about hiring abroad and wondering how to start setting up a local entity in another country?

Setting up an entity involves several steps and considerations. The specific process can vary depending on the jurisdiction and the type of legal entity you want to establish. However, here's a general overview of the steps involved in setting up a legal entity for a company.

So the big question is: should you set up your own legal entity or work with a company that takes care of onboarding? Let’s first see what goes into setting up your own legal entity.

Here’s a step-by-step guide for the entire process:

Choose a jurisdiction: Determine where you want to establish your legal entity. This could be in the country or state where your business operates or another jurisdiction with favourable business laws.

Choose the type of entity: Decide on the type of legal entity that best suits your company's needs. Types of entities also differ based on the country you decide to go with, but the following are the most common types:

- Sole proprietorship: Simplest form, but offers no separation between personal and business liabilities.

- Partnership: Similar to a sole proprietorship but involves multiple owners.

- Limited Liability Company (LLC): Provides personal liability protection for owners while maintaining flexible management.

- List Corporation: Offers strong liability protection, formal structure, and the ability to issue stock to raise capital.

Select a business name: Choose a unique and available business name that complies with the regulations of your jurisdiction. Also do a thorough check to see if this name is available or already taken.

Register the entity:

- Select a law firm to work with

- Prepare documents for incorporation

- File the necessary paperwork with the appropriate government agency. This often involves submitting articles of incorporation/organisation or partnership agreements, depending on the type of entity

- depending on the type of entity, you might need to draft bylaws (for corporations) or an operating agreement (for LLCs)

- Pay any required fees

Obtain an Employer Identification Number (EIN): This is a unique identification number issued by the government for tax purposes. It's necessary for hiring employees, opening a business bank account, and filing taxes. This is applicable in most countries, but may not be called EIN in every country.

Fulfil regulatory requirements: Depending on your industry and location, you might need to obtain specific licences or permits to operate legally. This could include health permits, environmental permits, and more. Another potential required step is contacting Health & Safety vendors for mandatory health checks for employees as part of regulatory compliance.

Open a bank account: Set up a business bank account to keep your personal and business finances separate. This can be a long and complex process. Usually, you have to go through extensive KYC and a tedious onboarding process.

Set up financial and legal infrastructure: Establish accounting and book-keeping systems (such as sourcing a local provider to handle accounting) to keep track of your company's finances. Also, consider consulting with legal and financial professionals to ensure compliance with all regulations.

Comply with tax requirements: Register for local, state, and federal taxes as required. This might include income tax, Value Added Tax (VAT), sales tax, and employment taxes.

Ultimate Beneficial Owners (UBO) registration:The UBO register is a register in which all “Ultimate Beneficial Owners'' or “beneficial owners” of a company or another legal entity are registered.

Hiring employees: If you plan to hire employees, you'll need to comply with employment laws, obtain workers' compensation insurance, and set up payroll systems.

Protect intellectual property: If your company has intellectual property (patents, trademarks, copyrights), consider registering these to protect your rights.

Stay updated: Maintain compliance with ongoing legal and regulatory requirements, which can include filing annual reports, renewing licences, and paying taxes

It's important to note that setting up a legal entity can be complex and requires careful consideration of legal, financial, and operational factors. Consulting with legal and financial professionals who are familiar with the regulations in your jurisdiction is highly recommended to ensure that you navigate the process correctly.

What if we told you there’s an easier way?

With our solution WorkGlobal, we can help you hire employees easily through an Employer of Record (EOR).

How does an EOR benefit you?

How can WorkMotion help you hire abroad without your own legal entity?

With WorkGlobal, you can hire skilled talent in 160+ countries without setting up a local entity with our Employer of Record (EOR) services. An EOR is a service provider that manages the legal, HR, tax and local compliance responsibilities of your talent in any country where you don’t have your own legal entity. An EOR hires, onboards and pays your talent on your behalf. The EOR is the legal employer while you retain the role of managing employer, looking after the day-to-day management of the talent.

In other words, you decide who to hire, how to compensate, what work to perform and when to terminate. The EOR is your HR service that helps keep your business compliant with local laws in the country, where your talent lives and works.

Let’s assume you want to expand into France, hire developers in Ukraine and Poland, and have a sourcing manager in China. That's 4 different countries, with completely different labour laws, work contract regulations, HR processes, payroll difficulties and compliance risks.

In that case you simply provide the EOR with information about who you want to hire and other basic data (start-date, compensation, etc.). The EOR then navigates the local laws and handles all the paperwork for onboarding the talent. This frees you of the cost, time and distraction of bureaucracy and more importantly, allows you to focus on growing your business

An EOR hires the employees in the new country under its local business entity and takes on all of the legal risk. As the legal employer, WorkGlobal is responsible for:

- Employment contract and compliance

- Adhering to local labour laws

- Advice on required notice periods and termination rules

- Check visa, immigration and work permit status

- Country compliant payroll and taxes

- Payments of salaries, taxes and social security

- Benefits(e.g. statutory ones such as holidays, maternity leave, etc.

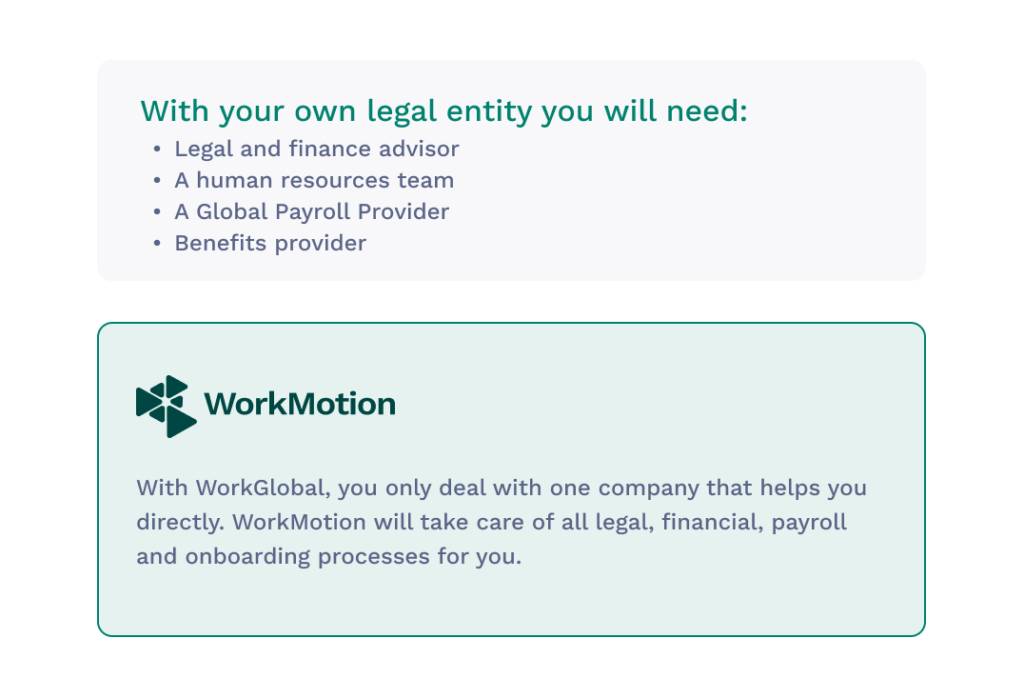

Your own legal entity vs. WorkGlobal

Should you open your legal entity or work with WorkGlobal?

Why use WorkGlobal?

| Categories | Local Entity | WorkGlobal |

|---|---|---|

| Employment contract & compliance | Whole infrastructure needed. Typically you need both internal and external support to be locally compliant: HR team, Legal & Financial Advisors, etc. Every country has its own termination and employment laws. It is vital to follow regulations and stay compliant | WorkGlobal takes care of everything. WorkGlobal has the entire infrastructure and both internal and external support available. WorkGlobal will take care of all legal, financial, payroll and compliance matters. WorkGlobal provides you with the latest information, ensures compliance and lawful termination of talent. |

| Payroll | Ensuring correct salary payments, withholding taxes, etc. are in most countries responsibilities of the employer. You will have to find a global payroll provider who can help you. | WorkGlobal is responsible for payroll and will make sure payroll is compliant. |

| Payments & bank account | Oftentimes it is a legal requirement to have a local bank account when paying employees. | WorkGlobal will provide the banking infrastructure to ensure payments to your employees, the tax authorities and social security. |

| Benefits | To retain talent it is necessary to provide best-in-class benefits to your international workforce. Identifying providers in each country is time consuming and costly. | WorkGlobal will have a whole range of benefits options available, through the established global network of benefit providers. Oftentimes premiums are also way cheaper due to large group discounts. |