Contractors

Hire, pay and manage contractors and freelancers easily in 160+ countries with automated invoicing, effortless payments and a model designed to protect you from legal risks and hefty fines.

Say goodbye to international contractor hiring complexities. Our contractor management solution keeps you safe from legal risks and costly mistakes.

Avoid misclassification and compliance mistakes and get guidance that helps you make the right decisions for your business—be it freelancers, contractors or full-time employees.

The only surprise? How easy it is.

“The customer support was extremely responsive and fast. Everything about my contract as a payroll employee was handled in a perfect way.”

Matt,

Matt, Creative Project Manager, Netherlands

“After everything is set up the service runs very smoothly and both expense handling as well as one-off payments are very effective”

Arno,

Arno, COO, Netherlands

“Everything about my relocation process went smoothly, the support I received was always friendly, helpful and timely.”

Lucas Cupido,

Senior Data Engineer, Spain

“The ease of use of the platform and especially the support team, who are always nice and helpful. Everything is nice and easy.”

Jon Ramos,

Application Engineer, Spain

“WorkMotion's customer service team has been exceptional. They are responsive, knowledgeable, and always willing to assist with any inquiries or issues that arise.”

Angela Ivanovic,

Sales Representative, Croatia

“Whether you're a seasoned HR professional or new to the field, you'll appreciate how easy it is to accomplish tasks within WorkMotion.”

Gombos Lorand,

Developer, Romania

Misclassification, labeling a worker as a freelancer or contractor when they should be an employee, can put your business at serious risk. Labour authorities are actively pursuing these cases, and the penalties are steep. In Europe, you could face fines of up to €500,000 per misclassified worker.

Plus, negative media coverage can destroy your reputation, eroding customer and investor trust. And audits and lawsuits drain your resources and hinder your long-term growth.

Global expansion shouldn't feel like walking a tightrope. WorkMotion makes compliant contractor hiring so easy, you'll wonder why you ever did it any other way. Focus on scaling, we'll handle the small print.

With our Contractor Misclassification Tool, you can:

Identify potential risks early on

Create compliant contracts with confidence

Protect your business from legal, financial, and reputational damage

Tailored misclassification risk assessment tools.

Contracts have a built-in NDA clause

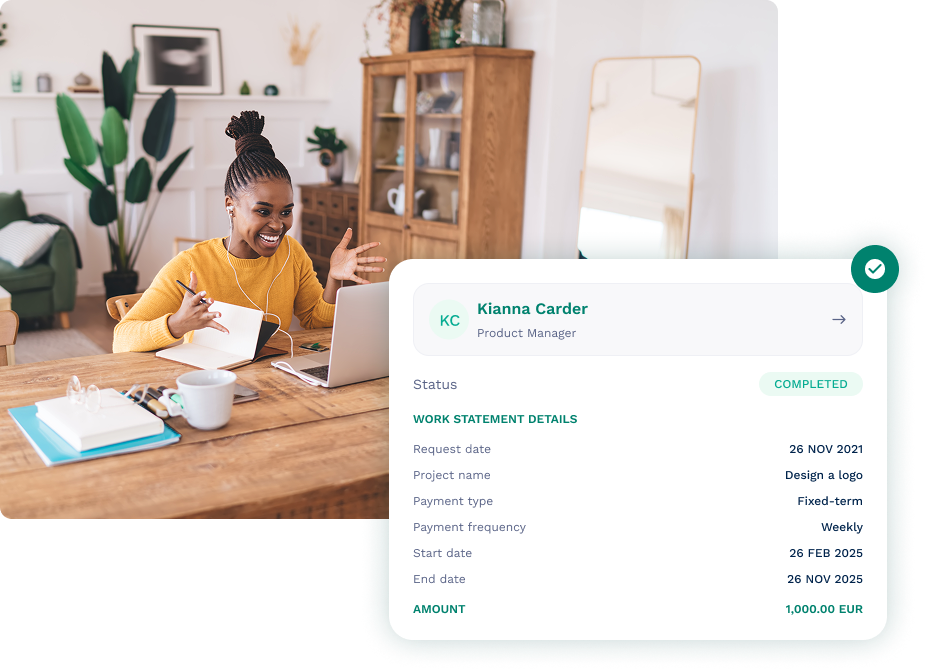

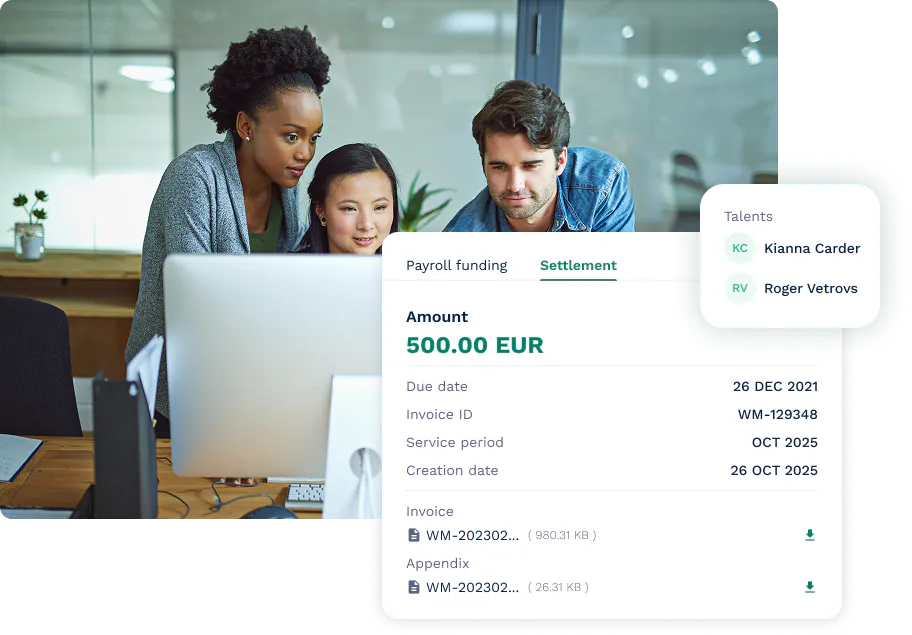

Automated invoicing and streamlined payments

Flat, transparent pricing model with no hidden fees

Comprehensive support for flexible contract types

“WorkMotion takes care of 90% of our admin team’s workload, enabling us to tackle more strategic tasks."

Yentl Spiteri, Founder & Creative at Von Peach

Subscribe to our newsletter

Receive regular tips, news and insights about international employment and remote work.

Adding {{itemName}} to cart

Added {{itemName}} to cart