Navigating Taxable Compliance

When it comes to talent expenses, tax compliance may not be top of mind, but it is something that can lead to significant penalties for your organisation. Did you know that depending on the type of expense, there are different rules based on the country your talent is in? The impacts of this include:- Whether the expense type/category is taxable or not.

- If the expense type/category is taxable and the amount of that expense that is taxable.

Taking Spain as an example, mistakes made in relation to false expense reporting for tax purposes can be up to 50%-100% penalty fee of the amounts incorrectly reported.

Just imagine that number multiplied by the number of talent in the various countries where you have onboarded talent. The potential penalty fees levied on your company can quickly get out of hand.Solutions In the Market Don’t Cut It

In the market, there are third party software tools available to help with talent expense management, but many of these lack the underlying automated logic needed for country specific tax compliance. So while you can leverage their software to manage your talent expenses, they will not notify you whether these expense categories are taxable in a specific country and the amount that is taxable within those categories. Other global onboarding providers also offer basic expense reporting functionality without the automated tax compliance logic that WorkMotion’s expense feature offers. You will need to rely on manual categorization of taxable expenses which can lead to human errors as well as taking up valuable time.WorkMotion’s Easy Expense Check Management

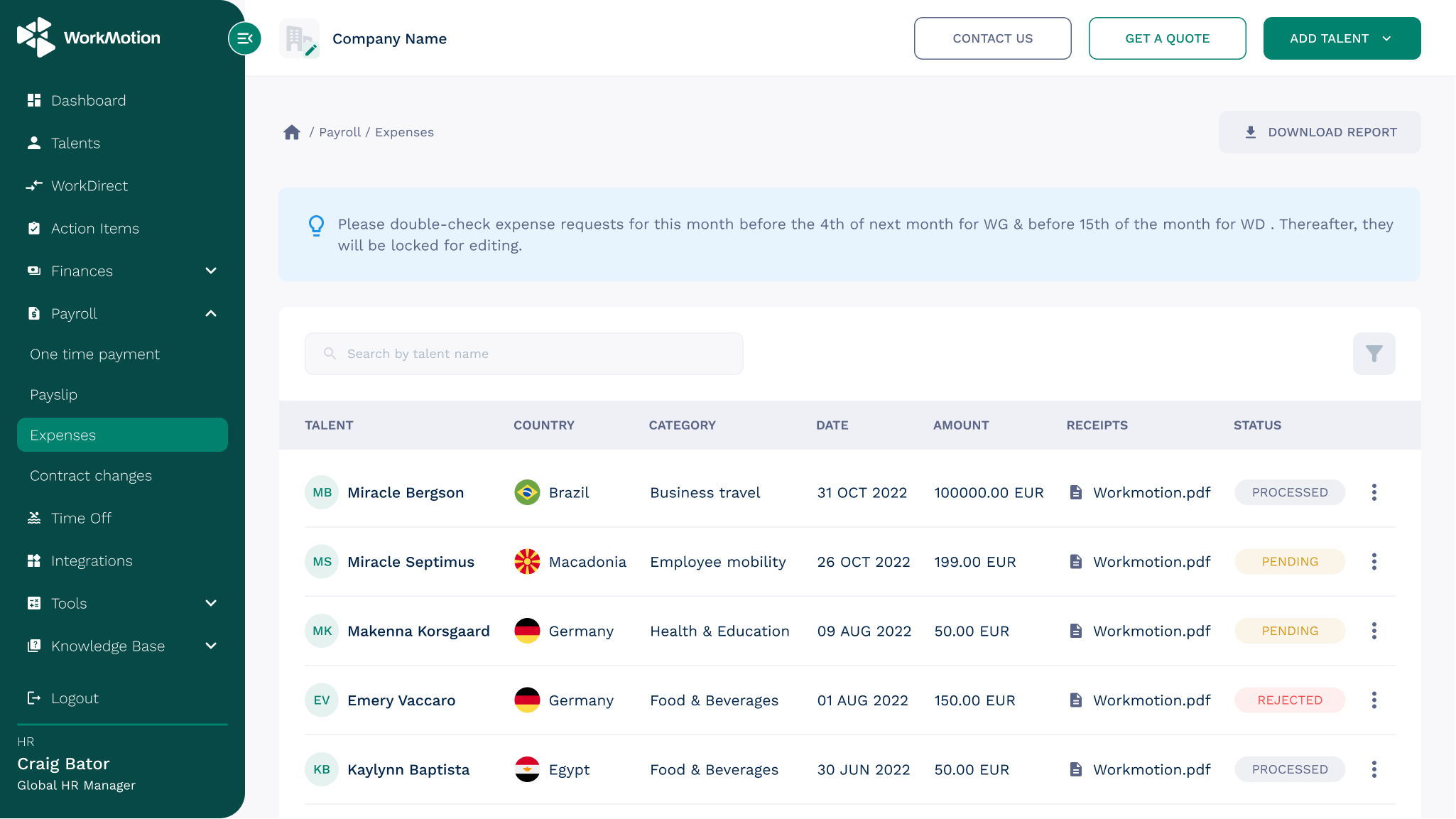

With our expense management feature, your talent can now enter all their expenses accurately in our platform and you can identify which expenses fall under taxation. We have included all the required input fields for different categories of expenses following each countries’ rules for taxation.