We often encounter customers who are excited about global hiring and eager to proceed, but are stumped by an important question.

- How much salary should they offer to their international talent?

- How do you decide the salary of an employee in Spain, considering income differences, cost of living, and taxes?

- How do you come up with a number that’s fair to both your business and the talent?

- How do you determine salary differences between employees in the same position across different countries?

We hear you, and we have two valuable tools to help you determine compensation for your new talent abroad and make competitive offers that work for them and your business.

When companies expand globally, they quickly realize that local benchmarks alone are not enough. Businesses need a structured approach to run a global salary comparison and understand real-world compensation differences. This is where international salary comparison becomes essential—helping employers balance fairness, compliance, and cost efficiency while building distributed teams.

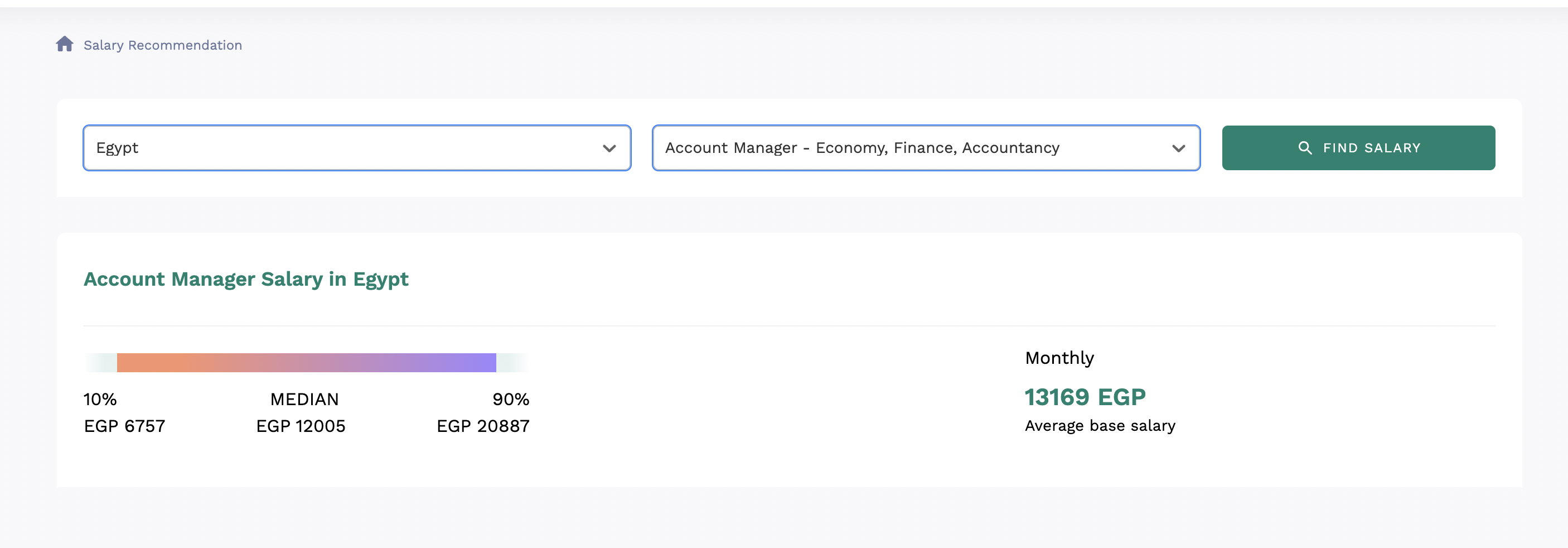

#1: Salary Recommendation

If you already have an open position and would like to see average salary ranges across countries, this tool can provide an instant overview. Simply enter the country, select the designation from the drop-down menu, and click on ‘Find salary.’

The results will show you the recommended average salary for your preferred position.

Not only will you see the recommended average wage, but you will also see the minimum, median, and maximum.

This feature is a practical global salary calculator that enables employers to compare salaries across countries for the same role instantly. Instead of relying on guesswork, companies can confidently compare salaries across countries using reliable market data.

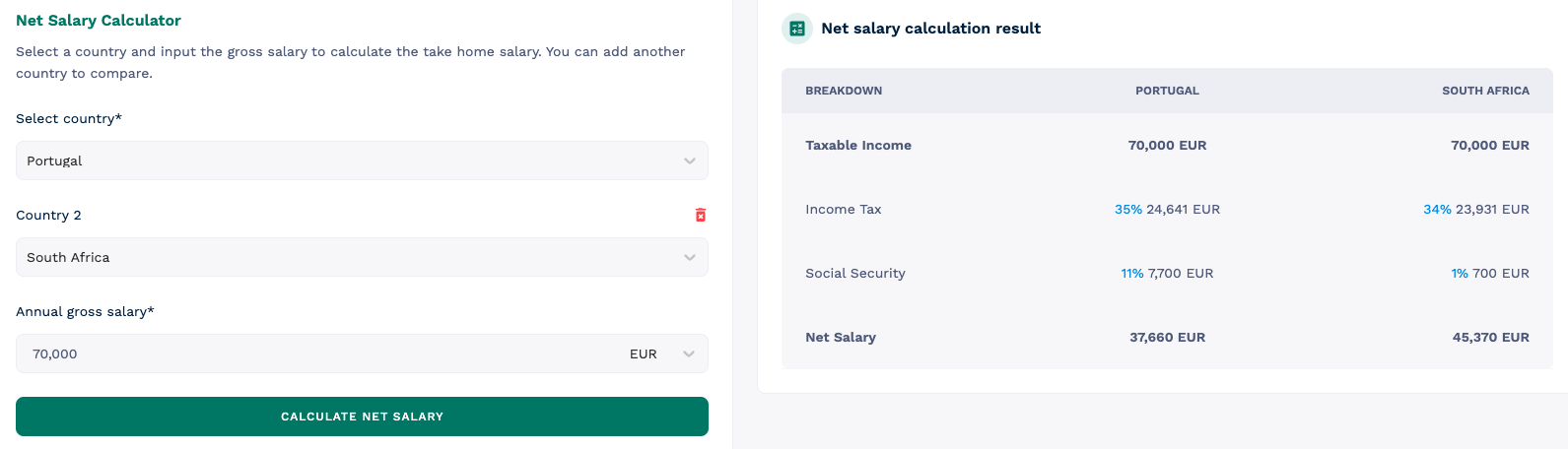

#2: Net Salary Calculator

This tool allows you to:

- Calculate the net salary in a country

- Compare it with the net salary in another country (when paying the same salary and in the same currency)

- Calculate and compare the net salary in the following three currencies: Euro (EUR), United States Dollar (USD) and Pound Sterling (GBP)

In the example below, let’s compare the salary of a person living in Portugal earning 70,000 euros gross annual salary to a person earning the same annual gross wage but living in South Africa:

Click on “Calculate net salary,” and you will see the results. Based on extensive background data, our tool synthesises net salaries instantly and provides a comparison of hiring costs across both countries. This ensures your international team members are paid equitably, regardless of location.

The differences in salaries are due to tax and social security deductions in the respective countries. We currently have 25 countries available, and we plan to add more in the future. Would you like to give it a whirl? Our team is ready to help you create the best hiring strategy for your team. If you’d like to understand how these tools work in more detail, book a guided demo here.

Think of this as an equivalent salary calculator international teams can rely on. It shows the true take-home pay across locations and enables a transparent salary comparison between countries—critical for maintaining internal equity in remote-first organizations.

How to Decide Salaries for Remote Employees

One of the most common and complex questions global companies face is how to decide salary for remote employees. There is no single formula that works for every organization. Some businesses prefer a location-based approach tied to local market rates, while others opt for role-based or global market-based compensation. In reality, the most sustainable approach often blends all three—using role benchmarks as a foundation, while adjusting for cost of living, tax structures, and local labor market expectations.

A well-designed remote employee salary guide helps organizations strike this balance. It allows companies to build consistent salary bands across regions without ignoring local realities that impact take-home pay. By leveraging a data-backed global hiring salary tool, employers can benchmark roles accurately, reduce unconscious bias, and ensure salary decisions are transparent, fair, and aligned with a long-term hiring strategy rather than short-term guesswork.

How to Compare Salaries in Different Countries

If you’re evaluating how to compare salaries in different countries, it’s important to look beyond gross salary figures. What truly matters to employees—and to employers—is net income. Local taxes, social security contributions, mandatory benefits, and purchasing power can significantly change the real value of a salary from one country to another.

Tools that support international salary comparison make these differences visible by translating gross pay into real take-home earnings. This enables companies to understand the true cost of hiring and helps employees see how their compensation compares globally. Taking this structured, data-driven approach not only improves fairness and consistency but also strengthens compliance and transparency—especially for organizations scaling distributed teams across multiple countries and jurisdictions.

Using Global Salary Data to Build Fair and Competitive Offers

Global hiring decisions increasingly start with accurate global salary comparison data. When companies expand internationally, they need more than intuition or headquarters-centric benchmarks. They need structured salary intelligence that reflects real market conditions across regions. A well-executed salary comparison between countries helps employers design offers that are competitive locally while staying aligned with global compensation strategy.

To compare salaries across countries effectively, organizations must account for factors such as role demand, seniority, local labor market maturity, and statutory employment costs. For example, identical job titles can command very different salary ranges depending on location. Without standardized benchmarks, businesses risk inconsistent offers that either inflate costs or weaken employer branding.

This is where a data-backed global salary calculator or global hiring salary tool becomes critical. These tools provide consistent reference points, enabling companies to benchmark roles and justify compensation decisions with confidence quickly. Employers increasingly seek tools that answer practical questions such as “What is a fair salary for this role in this country?” Clear, transparent salary logic not only improves offer acceptance but also strengthens trust and retention in globally distributed teams.

Why Equivalent Salary Calculations Matter for Distributed Teams

As remote work scales, equivalent pay becomes a core compensation challenge. Two employees earning the same gross salary may experience vastly different living standards depending on taxes, social security, and local purchasing power. This is why equivalent salary calculator international models are essential for fair global compensation planning.

An effective international salary comparison goes beyond surface-level numbers. It translates gross pay into net income and contextualizes what that income actually means in each country. For employers asking how to compare salaries in different countries, this approach provides clarity on actual hiring costs and employee value perception.

Using structured tools to support salary comparison between countries also strengthens internal equity. When employees understand that salaries are benchmarked using objective data—not arbitrary adjustments—trust increases. This transparency is particularly important for long-term remote teams, cross-border transfers, and fast-growing global organizations. Companies increasingly seek solutions that explain “why salaries differ globally” in clear, data-driven terms. Equivalent salary calculations help businesses scale responsibly while maintaining fairness, compliance, and employee confidence.

Country-Specific Salary Comparison Examples

To understand why global salary comparison matters, it helps to look at real-world examples. Consider a mid-level software engineer earning a gross annual salary of USD 70,000.

In Germany, higher income taxes and social security contributions mean the employee’s net take-home pay is significantly lower than the gross amount. Still, substantial public benefits and purchasing power offset some of the difference. In contrast, the same gross salary in India results in a much higher relative purchasing power due to lower living costs, even after taxes.

Now compare Spain and Poland for the same role. While gross salaries may appear similar, differences in tax brackets and mandatory contributions affect net income. This is why companies conducting international salary comparison exercises rely on net salary data rather than headline numbers alone.

These examples show how misleading it can be to rely on one-country benchmarks. Using tools that support salary comparison between countries allows employers to make equitable offers and confidently compare salaries across countries without disadvantaging employees or overspending budgets.

Salary Comparison Between Countries: Example Table

The table below illustrates how the same gross annual salary can yield different net outcomes, underscoring the need for structured tools to compare salaries across countries.

| Country | Gross Annual Salary | Estimated Net Salary | Key Factors Impacting Net Pay |

| United States | USD 70,000 | Higher net retention | Lower social security burden |

| Germany | USD 70,000 | Moderate net pay | Higher taxes, social benefits |

| Portugal | USD 70,000 | Lower net pay | Progressive income tax |

| South Africa | USD 70,000 | Variable net pay | Tax brackets, local deductions |

This type of comparison is exactly what a global salary calculator or equivalent salary calculator international model is designed to simplify. Instead of manually estimating deductions, employers can instantly see how compensation compares across locations and make informed hiring decisions using a reliable global hiring salary tool.

Conclusion: Simplifying Global Compensation with WorkMotion

Setting fair and compliant salaries across borders doesn’t have to be complex. With the right tools and frameworks for global salary comparison, companies can confidently answer critical questions about compensation, equity, and cost control. Whether you’re deciding how to decide salary for remote employees or figuring out how to compare salaries in different countries, structured data is the foundation of sustainable global hiring.

WorkMotion supports this journey end-to-end. Through its Employer of Record (EOR) solution, companies can hire employees internationally without establishing local entities, while ensuring compliance with payroll and benefits. Direct Hiring enables organizations with established entities to manage global teams efficiently, while Contractor Management helps engage international contractors and reduce misclassification risks.

Combined with tools that enable accurate international salary comparison and transparent salary comparison between countries, WorkMotion empowers businesses to build, pay, and scale global teams with confidence. For a deeper dive into payroll, compliance, and execution, explore our guide on how to pay international employees and take the next step toward frictionless global hiring.